haven't done my taxes in 3 years canada

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. There could be many reasons why a person wouldnt have paid their taxes for several years.

The Penalties For Late Tax Filing 2022 Turbotax Canada Tips

425 68 votes If you dont file within three years of the returns due date the IRS will keep your refund money forever.

. If it turns out. Section 239 of the Income. You could owe a lot of money and not be able to afford to repay it you might have forgotten to pay.

If you dont have W-2 forms for your income for years past you can try to reconstruct what you earned based on paystubs checkbook registers or other similar documentation. Ad Get Back Taxes Help in 3 Steps. Additionally failing to pay tax could also be a crime.

Ad A Tax Advisor Will Answer You Now. According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison. The IRS estimates that 10 million people fail to file their taxes in any given year.

Its possible that the IRS could think you owe taxes for the. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. In a normal year.

If you file your tax return the statute of limitations prevents the IRS from conducting an audit of your taxes for a particular year after 3 years have passed since you. The longer you wait to file your taxes the more penalties you will owe and the likelihood of the CRA seeing your avoidance as tax. If you fail to file your tax returns you may face IRS penalties and interest from the date your taxes were.

If you have unfiled tax. Under the Internal Revenue Code. Get in contact with an accountant who specializes in taxes explain the situation and get your paperwork in.

Its possible that the IRS could think you owe taxes. Most Canadian income tax and benefit returns must be filed no later than April 30 2018. I didnt file taxes for four years 2011-2014.

Answer 1 of 24. 475 62 votes If you dont file within three years of the returns due date the IRS will keep your refund money forever. You legally have 3 years to file income tax so no problems there - youre not in trouble or anything.

However if you did owe money there would be interest on it probably jot a big deal. They are very helpful and will mail you all of your T4s and any other relevant tax documents that you need. We Can Help Suspend Collections Liens Levies Wage Garnishments.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Live QA with an Expert. No matter how long its been get started.

You are not the only person to have gone years without submitting. You have 3 years from the due date of the return to file and claim a refund. If you have any questions about the above information please dont hesitate to call me at 250-381-2400 and I would be glad to help you through the process.

Not filing a tax return on time is one of the most common tax problems. Get Your Return Filed Or You Could Lose Your Right To Claim A Tax Refund. Self-employed workers have until June 15 2018 to file their tax return.

Cara Menghasilkan Uang Cara Financesavingandinvestmentmacroeconomics Menghasilkan Uang Money Management Advice Investing Money Finances Money

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Video Creative Background Series Stampin Up Creative Elements Hand Stamped Cards With Josee Smuck Stampin Up Canada Demonstrator Hand Stamped Cards Stamped Cards Creative Background

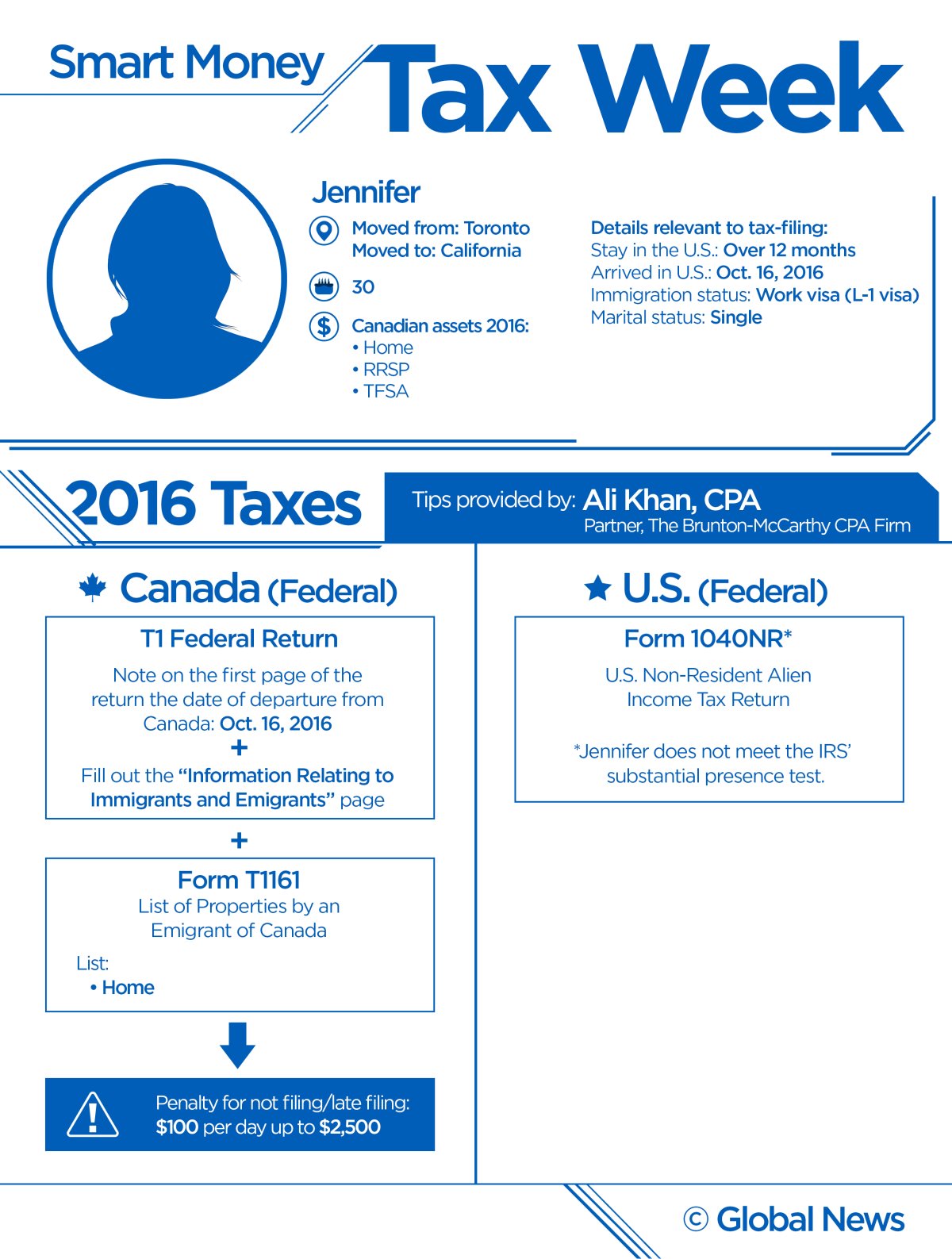

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Monthly Budget Template For Restaurant Restaurant Budget Template Usages Of The Re Budget Planner Template Business Budget Template Monthly Budget Template

Map Of Togo Togo Africa Travel French West Africa

Missed The May 2nd Tax Deadline It S Not Too Late 2022 Turbotax Canada Tips

Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips

Silk Kimono Robe Long Satin Robe 24 Colors Mulberry Silk Etsy Canada Gaun Gaun Kimono Robe Gaun

Harvey S Canada Coupon Buy One Get One Free Double The Burgers Original Burger Coupons Canada Coupons

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

How Far Back Can The Cra Go For Personal Income Taxes 2022 Turbotax Canada Tips

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Marsala Floral Wedding Invitation Set For Bohemian Wedding Etsy Floral Wedding Invitations Wedding Invitation Sets Wedding Invitations Diy

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

The World Coffee Index 2021 Vivid Maps Coffee Prices Africa Trip Advisor

Mi Vida Loca Director Writer Allison Anders Unique Look At The Inner Structure Of A Part Of L A S Echo Park Gang Life Shown From The Loca Loca Dvd Cine